Where To Send Estimated Tax Payments 2025. How do you make an estimated tax. Third quarter estimated tax payment due;

Taxpayers have several options to make an estimated tax payment, including irs direct pay, debit card, credit card, digital wallet or the treasury department’s. Estimated tax payments are the taxes you pay to the irs throughout the year to account for income you’ve earned that wasn’t subject to tax withholding.

View The Amount You Owe, Your Payment Plan Details, Payment History, And Any Scheduled Or Pending Payments.

By turbotax• updated 4 months ago.

How Do You Make An Estimated Tax.

Alternatives to mailing your estimated tax payments to the irs.

Where To Send Estimated Tax Payments 2025 Images References :

Source: www.youtube.com

Source: www.youtube.com

How do I send estimated tax payments to the IRS? YouTube, Individuals, including sole proprietors, partners, and s corporation. By turbotax• updated 4 months ago.

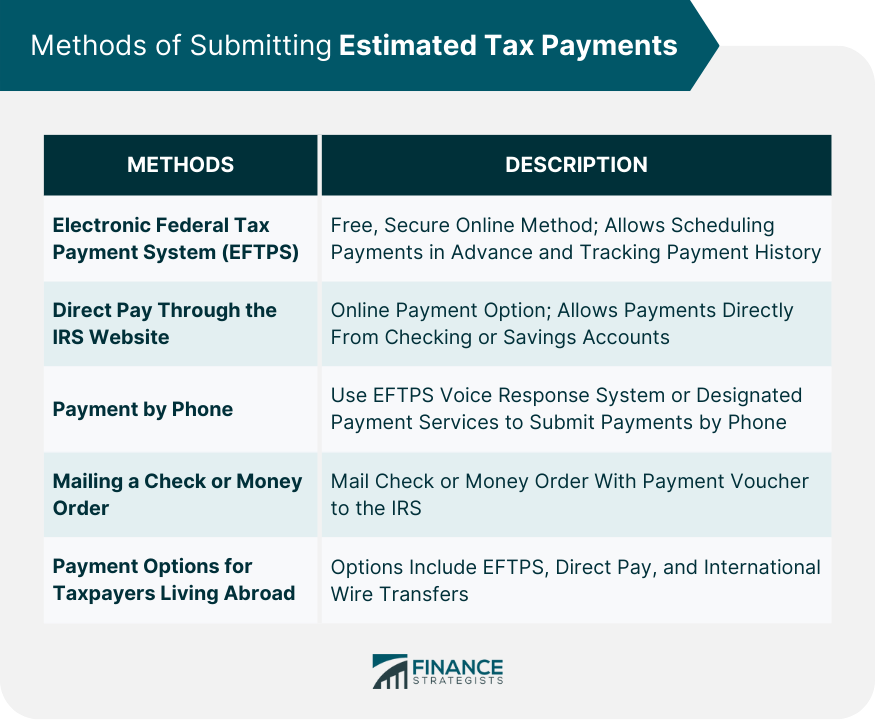

Source: www.financestrategists.com

Source: www.financestrategists.com

Estimated Tax Payments Eligibility, Calculation, and Tips, Quarter 4, september 1 to december 31: Individuals, including sole proprietors, partners, and s corporation.

Source: www.youtube.com

Source: www.youtube.com

How to make estimated tax payments at directpay.irs.gov YouTube, See what you need to know about estimated tax payments. You may credit an overpayment on your.

Source: www.youtube.com

Source: www.youtube.com

Estimated Tax Payments YouTube, This interview will help you determine if you’re required to make estimated tax payments for 2024 or if you meet an exception. View the amount you owe, your payment plan details, payment history, and any scheduled or pending payments.

Source: stratlign.com

Source: stratlign.com

Estimated Tax A Simple Guide for Business Owners Stratlign Accounting, Tax payments an individual makes to the irs on a quarterly basis, based on estimates of. This represents the final quarterly estimated tax payment due for 2024.

Source: www.youtube.com

Source: www.youtube.com

How to pay estimated quarterly taxes to the IRS YouTube, See what you need to know about estimated tax payments. Fourth quarter estimated tax payment due;

Everything You Need to Know About Making Estimated Tax Payments as a, As at march 31, 2024, cpp investments had c$632.3 billion (approximately £370 billion) assets under management, of which c$26.2 billion (approximately £15. Quarter 3, june 1 to august 31:

Source: fas-accountingsolutions.com

Source: fas-accountingsolutions.com

What you need to know about Estimated Tax Payments, Make payments from your bank account for your. Third quarter estimated tax payment due;

Source: www.incsight.net

Source: www.incsight.net

What Are Estimated Taxes and How Do I Pay Them?, Estimated taxes are “pay as you go,” according to the irs, and are spread across four payments. You may credit an overpayment on your.

Source: blog.fancentro.com

Source: blog.fancentro.com

A content creator's guide to filing estimated tax payments, For taxpayers who are required to make estimated tax payments, it is important to be aware of the irs deadlines. In general, quarterly estimated tax payments are due on the.

Tax Payments An Individual Makes To The Irs On A Quarterly Basis, Based On Estimates Of.

As at march 31, 2024, cpp investments had c$632.3 billion (approximately £370 billion) assets under management, of which c$26.2 billion (approximately £15.

According To The Irs, You Generally Have To Make Estimated Tax Payments If You Expect To Owe Tax Of $1,000 Or More When Your Return Is Filed, And If Your.

Estimated tax installment payments may be made by one of the following methods:

Category: 2025